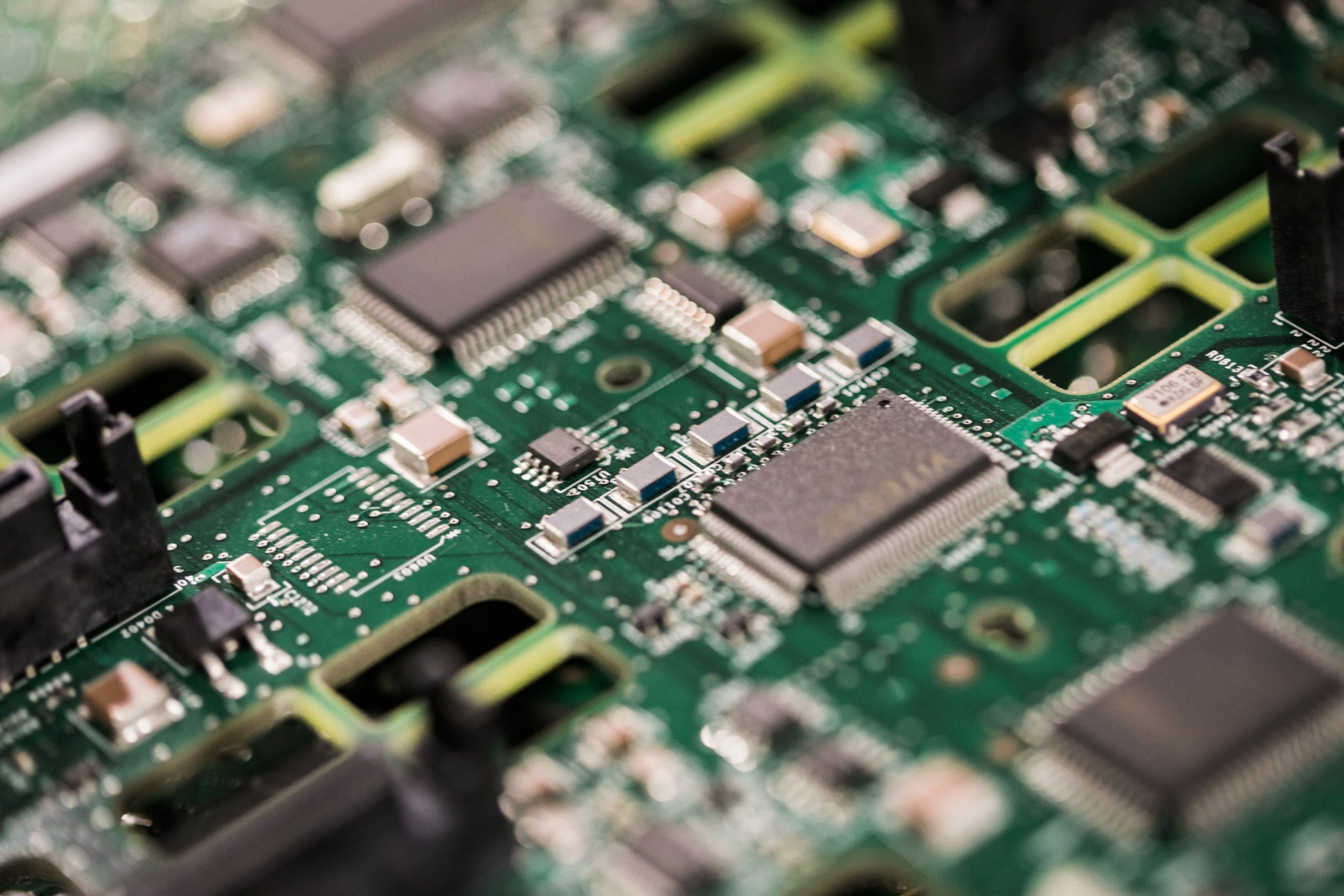

The current global chip shortage continues to persist and has been impacting organizations across nearly every industry. The situation we are facing is the result of a perfect storm inflamed by the pandemic, along with several other contributing factors. During the COVID peak in 2020, several manufacturing industries, especially automobile OEMs, slowed production or closed factories altogether as a result of travel restrictions and lockdowns. Meanwhile, lockdowns also increased demand for remote devices when the world began working from home and classrooms went virtual. To accommodate this WFH spike, cloud providers placed large chip orders to power their massive data centers. OEMs continued to buy large supplies of chips to prepare for the rollout of 5G devices, shrinking the supply even more. As if that weren’t enough, in late 2020, many industries, particularly auto, miscalculated consumer demand which picked up much faster than predicted, amplifying the struggle to acquire chips. Fabrication centers used to build chips cost billions of dollars to construct and years to inspect. Therefore, a “quick fix” solution isn’t really feasible, especially when five fabrication centers own 54 percent of the global semiconductor capacity. Just this week, Bloomberg reported that the shortage is set to worsen as Covid restrictions tighten even further in Malaysia, a key player in the global semiconductor trade.

So, what does this mean for businesses and consumers?

The tech industry was blindsided by this shortage. Store shelves are empty, orders are unfulfilled and production bottlenecks are everywhere. Semiconductor lead times have been expected to reach up to 20 weeks. The experts all agree – we have a long dusty road ahead. Gartner expects the shortage will persist until the second quarter of 2022. Intel’s CEO, Pat Gelsinger, doesn’t foresee a healthy supply-demand situation until 2023. “For a variety of industries, I think it’s still getting worse before it gets better.”

Manufacturing companies that operate machinery using computers or navigation systems are primarily seeing the direct effects of the shortage. Dell, HP and Lenovo have all noted that PC prices are likely to be higher in the second quarter and throughout the rest of 2021 as vendors pass along higher-priced components and logistical costs. Additionally, vendors have noted that demand is still strong and buying behavior hasn’t changed due to increased prices or delays. Dell’s CFO, Tom Sweet, states in a recent Forbes article:

“The pandemic overall accentuated the key role of technology and helping people do their jobs, learn from home, work from home and stay connected. In many ways it accentuated or accelerated the importance of technology and the digital platforms across the various ecosystems.”

In the midst of the worldwide chip shortage, many consumers and businesses are holding on to IT longer and turning to refurbished technology. Fortunately, EPC has been able to keep shelves stocked with the necessary equipment businesses need to stay productive. When the chip shortage is finally in the rear-view mirror and you’re able to install the IT refresh you so desperately need, it’s important that all the out-of-date equipment you’ve been waiting to upgrade is disposed in a safe and secure manner.

To see EPCs available stock of refurbished computers please visit: epcglobal.shop

Sources: